Inside Australia’s Impact Startup Ecosystem

We unpack three years of Australia’s impact startup landscape and what's coming next in Climate, Health and People.

Today, we’re excited to share the release of the Impact Startup Benchmark Report 2025.

This 3rd edition provides a comprehensive three-year view of Australia’s impact startup landscape and builds on our ongoing work to systematically track impact startup investment in Australia. Since Giant Leap’s launch in 2016, we have reviewed data from over 10,000 startups, making our dataset one of the most detailed sources on the ecosystem’s evolution. With each release, the data has become more robust and the findings more attuned to how the ecosystem is evolving.

This year, with data provided by Cut Through Venture, the report combines quantitative analysis with sector deep dives and first-hand stories from founders and investors shaping the future of impact. Our focus remains on sectors closely aligned with our investment mandate: Climate, Health, and People.

This email skims the highlights of the report. If you prefer the full experience with more charts, interviews and deep dives, you can access the report here.

A note on methodology: We have taken a broad lens to acknowledge that impact is subjective. You can read our full impact methodology and how we have defined the sub-sectors referenced in the Appendix of the report on page 87.

Key takeaways

Impact sectors have shown resilience in volatile markets. Impact sectors rose from 38.9% of startup funding in 2022 to 55.6% in 2023, before settling at 41.5% in 2024. This stable allocation signals that investor conviction around impact is strong, with sustained capital support even through a challenging environment.

Climate remains the dominant theme in Australia. Climate has consistently attracted the highest levels of investment across impact sectors, underpinned by clear policy signals and strong corporate demand. Investment is shifting towards emerging solutions, signalling growing conviction in technologies that could define the next wave of decarbonisation.

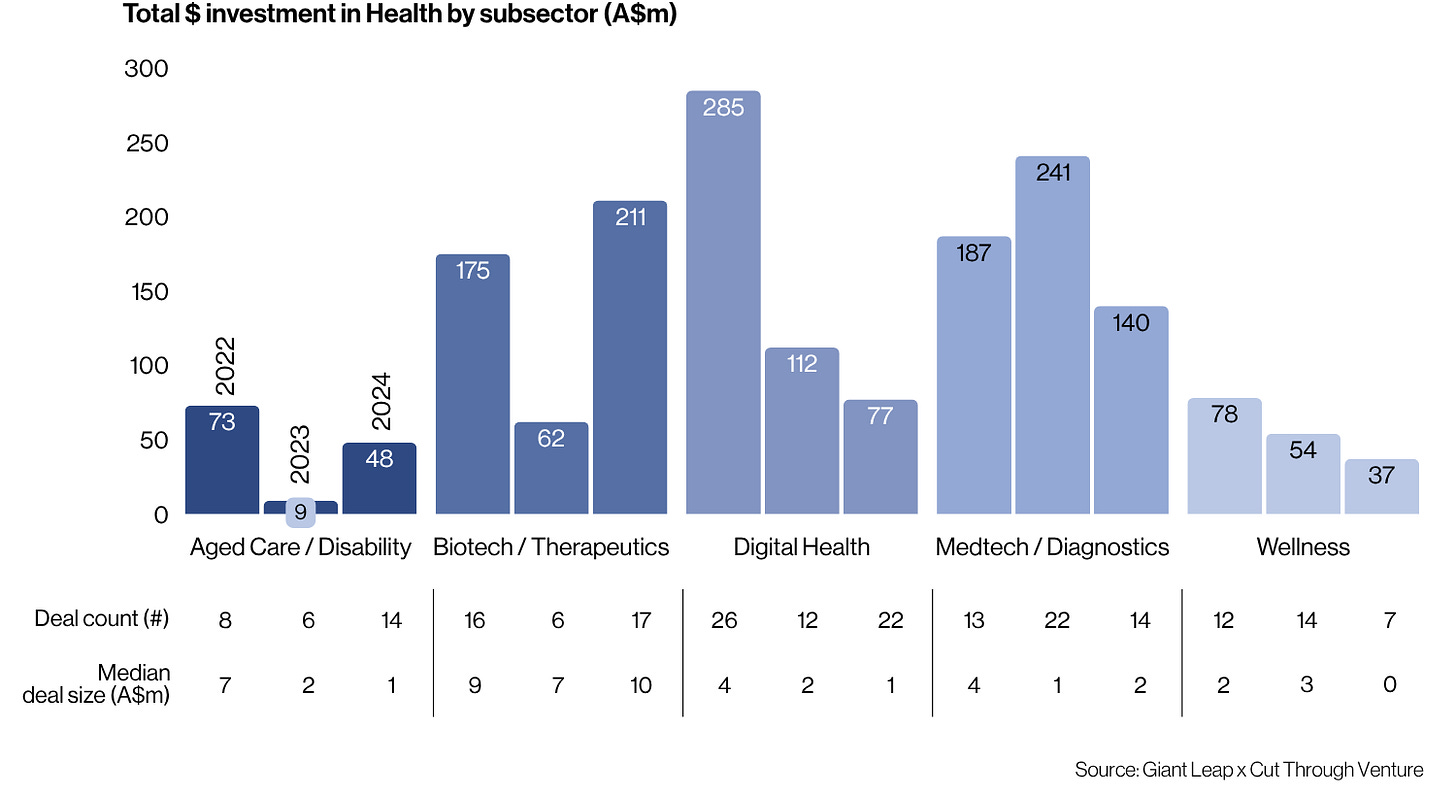

Health investment held steady. The Health sector has shown consistent investment levels, with Biotech / Therapeutics attracting the strongest backing. Conversely, digital health investment has softened, as uncertainty around commercial models, regulatory navigation and payer dynamics continues to temper investor enthusiasm.

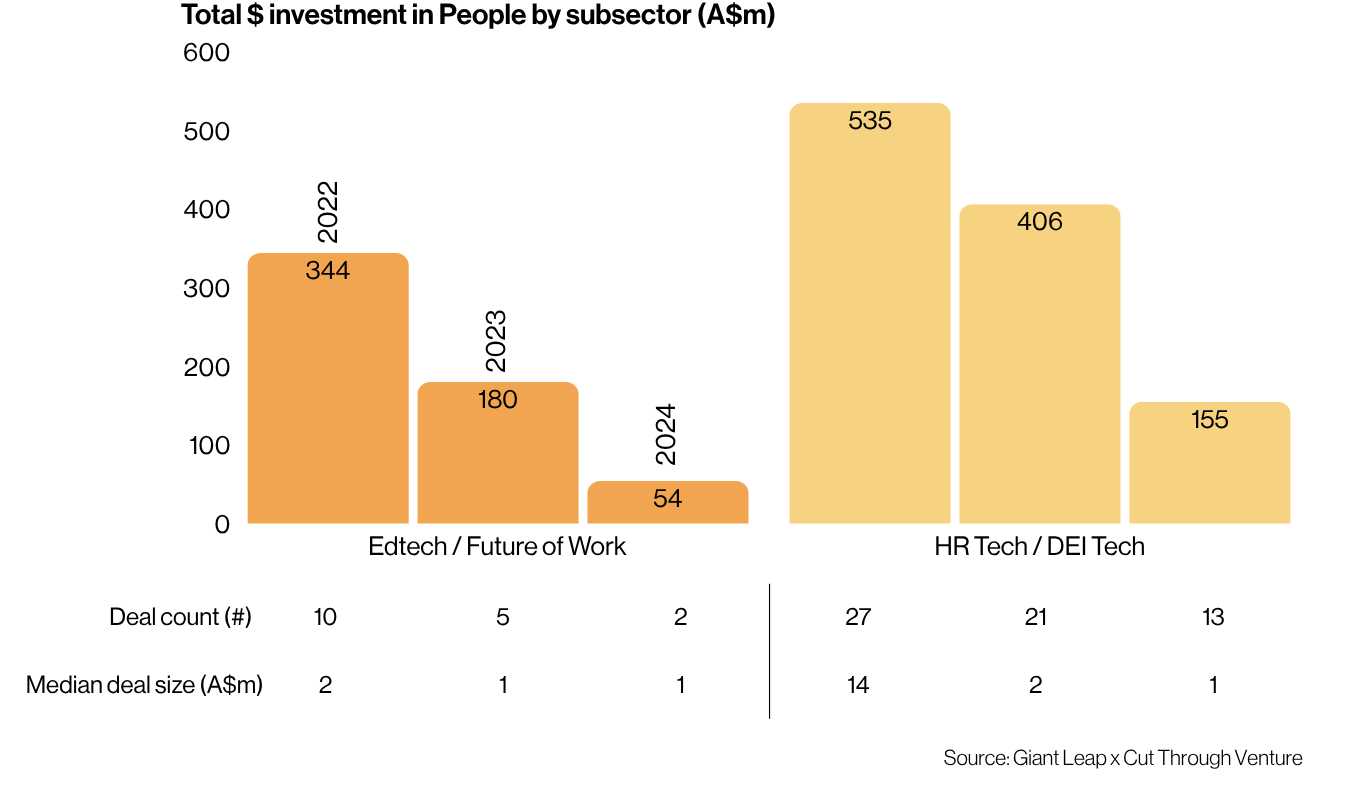

Investment in People, namely Edtech and HR Tech, experienced significant funding declines, reflecting a combination of structural and macroeconomic pressures including long sales cycles, customer acquisition challenges and broader economic uncertainty.

AI has become ubiquitous. AI has shifted from experimental use to a core operational enabler, significantly reshaping innovation in Climate, Health and People. This cross-sector adoption is not only accelerating innovation timelines but also raising the bar for what constitutes defensibility.

Series A funding is a growing bottleneck with investors placing greater scrutiny on traction, operational efficiency and scalability. Series A activity has contracted for two consecutive years, with both deal count and median deal size declining.

Investors demand clearer signals before deploying capital. Startups that may have previously advanced on strong narrative now face more rigorous benchmarks, with investors placing greater scrutiny on traction, operational efficiency and scalability. There is also a focus on startups delivering what they promise, achieving milestones and maintaining execution over time.

Thematic investment is on the rise, with more fund managers aligning around areas like climate, health and deep tech.

Behind the numbers: Stories that shape the stats

The data offers a clear signal of where the ecosystem stands, but it’s the sector deep dives and interviews that reveal how founders and investors are adapting in real time. These perspectives help us understand not just what is happening, but why it matters and where it might go next.

In Climate: The climate sector continues to attract the lion’s share of impact capital, but the conversation is evolving. Our deep dives explore a shift from decarbonisation to resilience, emerging investment in biodiversity and regenerative agriculture, as well as products & materials, where market fit and scalability are coming into sharper focus.

Among the interviewees we spoke to were Sophie Purdom (Planeteer Capital) and Patrick Sieb (Climate Tech Partners), who reflected on where future climate opportunities lie, as well as Adam Jones (CLT Toolbox) and Natassia Grace (Conserving Beauty) who are each tackling the challenge of embedding sustainability into established systems.

In Health: Some of the most urgent and underserved opportunities are emerging in women’s health and longevity. These areas are attracting a wave of founder-led innovation and investor interest. Interviews with Ida Tin (Clue) and Ariella Heffernan-Marks (Ovum) explore what it means to close the health gap, and why now is the moment.

In People: Funding in Edtech and HR Tech has slowed, but AI is opening new possibilities. We spoke with Ben Sze (Teacher's Buddy & Edrolo) about how AI can support teacher workflows without compromising human connection, and Brian Dixon (Kapor Capital) on the greatest opportunities in edtech investment.

Alongside the report, we’ve updated our directory of key players in the Australian impact startup ecosystem: organisations offering capital, mentorship and co-working space to support early-stage startups. We’ve also included an updated directory of global impact-focused VCs to support founders exploring international capital.

If you’ve made it this far and haven’t yet clicked, get the full report here!

Let us know what resonated, what surprised you and how you’re thinking about what’s next.

P.S. We’ve launched our new website! Take a moment to explore it and share your thoughts. We would love your feedback!