Signing off for 2025!

Small Steps Vol. 121: Evidence, adoption and execution: lessons from ANDHealth, AI’s next frontier and where climate is heading next.

It has been a big year! Between the highs, the hurdles, and everything in between, the standout has been the founders who kept showing up with momentum and clarity.

For Giant Leap, 2025 has been a special chapter too. We announced investments in Ovum, Foremind, FlyORO, Indi and Teacher’s Buddy - five teams taking on big problems, stretching what’s possible in impact and innovation, and reminding us exactly why this work matters.

This is our final newsletter for 2025 and to close out the year, we’re sharing a conversation we’ve been looking forward to: an interview with Grace Lethlean from ANDHealth. Grace shared with us the practical realities of digital health commercialisation, as well as why progress often comes from patience, clarity and having the right support.

As we wrap things up, we want to wish you a restorative break - may it be a chance to recharge, reconnect and return with fresh energy.

Thanks again for being part of the Small Steps community - we’ll see you next year! 👋

Please note: Giant Leap’s office will be closed from Friday 19 December 2025, returning on Monday 5 January 2024.

An interview with Grace Lethlean

Digital health founders are building in a uniquely tough environment: where regulation, clinical evidence, behaviour change and fragmented health systems all collide.

Grace Lethlean, COO at ANDHealth has seen first-hand what it takes to not just generate evidence, but to turn that evidence into a product that health systems, patients and payers will actually adopt.

We sat down with her to talk about the gaps that sparked the ANDHealth+ program, the patterns she sees in companies that succeed, and what health systems and investors truly want from digital health.

What unmet need in the health ecosystem inspired ANDHealth+, and where were founders falling through the cracks in existing support systems?

One of the reasons I’m so passionate about what ANDHealth does is that I started out as a co-inventor of a digital health product myself.

Before ANDHealth started, there was essentially nothing in Australia that was truly digital health specific. Digital health companies would find themselves applying for medical research funding alongside drugs, with assessments heavily weighted to patent portfolios and known clinical development milestones. Alternatively, they would find themselves trying to generate revenues before focusing on clinical evidence to secure investment from more “tech” aligned investors and accelerators. Digital health companies just weren’t getting cut through.

ANDHealth’s Founder, Bronwyn Le Grice, came from a venture capital background and wanted to unlock the investment potential inherent in the nascent digital health sector. The challenge was that the companies just weren’t investable yet. They hadn’t answered some of the key “killer questions” you need to be able to answer before going to market. ANDHealth+ was designed to fill that gap, creating companies able to survive and thrive, attract institutional-grade investment and deliver products and services attractive to enterprise customers in the healthcare sector.

What are the biggest challenges you see health founders consistently underestimating?

The toughest question in digital health is almost always the business model.

Who’s going to pay? How will this be commercialised? Whether you’re selling to insurers, government, health systems, physicians, practices or consumers, or a combination of all of those, each path comes with a long list of follow-on questions.

Founders also tend to come in with a really strong bias towards their own background. We see companies led by patients, clinicians, caregivers, technologists and medical researchers. Each group has different strengths, challenges and blind spots.

If they come from a tech and product background, the UX and UI often look fantastic, but the clinical evidence requirements are not fully thought through or they believe avoiding regulation to get to revenue early is critical, rather than fully embracing regulation as a competitive defence and customer attraction mechanism.

Alternatively, if they come from a clinical research background, it’s usually the opposite. The medical data is excellent; the intervention works. But they may not have fully thought through how it fits into the clinical workflow outside their own lab or practice, or they are unaware of the regulatory thresholds, cyber and data security considerations or how to “plug in” to the bigger pieces of health infrastructure.

Pricing is another universal challenge. Innovators need to figure out how to determine and articulate the value they’re offering, and then price appropriately in a market that’s still emerging. They need to clearly identify who will pay, why they will pay and how they will pay, making health economics critical to the go-to-market plan. Is the product or service more like a device? A software subscription? A service? A hybrid of service and product? Something in between? The diversity of possible outcomes there is huge, and the external market is shifting rapidly, making support by people with super targeted domain expertise absolutely critical.

What differentiates the companies that succeed in digital health commercialisation from those that struggle?

One big differentiator is whether a company really understands how its product will be used in context, and by whom.

The best teams can clearly articulate three things: their users, their beneficiaries, and their payers. In digital health, those three are rarely the same. It’s often a chain of people and organisations, and mapping that chain correctly is critical.

The second differentiator is how open the Founders and CEOs are to having their assumptions challenged. For companies in the ANDHealth+ program, we curate a panel of experts across many disciplines from clinical practice, commercialisation, regulation, to product development, market access, and health economics. That panel meets monthly to have exactly those robust conversations.

We ask: what are the key assumptions? How can we derisk them? When new information comes in, how does it change the strategy?

We also deliberately bring in consumer, patient and community voices through the process. It’s one thing to have an elegant solution on paper; it’s another to have something that a patient actually wants to use, or that fits seamlessly into a nurse’s workflow.

That diversity of perspective can introduce constructive conflict, and I’m a big believer that conflict breeds creativity.

What do health systems want from digital health companies right now, and what do founders often misunderstand?

The Australian health system is better than most in the world, but it’s still incredibly fragmented. That fragmentation is at the heart of what founders need to understand.

When you pitch into a hospital or health service, you’re not just selling to a single buyer. You’re dealing with end users, clinical champions, procurement, IT, finance, executives - all with different priorities, budgets and constraints. You need a clear value proposition not just for the direct user, but for the broader system around them.

One common misconception is that because something is “just an app”, adoption will be straightforward. In reality, that app has to be picked up, used regularly, integrated into existing architecture and fit around a person’s life. Any time you’re asking for significant behaviour change, you’re taking on a big adoption risk.

Ultimately, technology itself doesn’t create productivity or profoundly change patient outcomes. Adoption does.

So, we encourage founders to start with the adoption question: what are the barriers and how can you design around them? There’s a lot of work being done at a system level to digitise and train the health workforce, but companies still need to own their piece of that adoption journey.

How should founders think about timing for global expansion?

The reality is that very few businesses are going to attract the eye of substantive VC cheques without a clear plan to access major international markets.

The single biggest challenge we see here is “US market or nothing” attitudes, with the vast majority of companies stating that their goal is to enter the US without any real experience or understanding of the US healthcare market in all its complexity.

When considering international markets from a go-to-market perspective, companies really should be spending a lot of time exploring the payment mechanisms and business/ revenue models which are most likely to drive adoption in that particular jurisdiction.

Factors such as mutual regulatory recognition, reimbursement structures, national digital health infrastructure, fast-track procurement pathways and understanding government funded pathways vs private pathways are all key drivers of selection of primary target markets for international expansion.

The ANDHealth+ International Investment committee, global leaders with over $6B of exits in digital health, provide clear guidance to our portfolio companies on these types of issues, with the consensus often being that the US is not the best, first international market to attempt to conquer.

What metrics or proof points are investors prioritising in digital health in 2025?

At ANDHealth+ we try to stay very close to this question. At a midpoint in the program, we pause and put our companies in front of investors and enterprise customers for structured feedback. We use that feedback to decide which projects to prioritise and, in some cases, whether it makes sense to keep going in a particular direction.

In larger jurisdictions such as the US and UK, there are dedicated digital health funds which focus specifically on this space, bringing deep domain expertise and global healthcare networks. In Australia, our dedicated healthcare investors are naturally more comfortable with pre-revenue companies with extended, deep tech, clinical development pathways, but lean in heavily to the traditional biotech and Medtech sectors. More generalist tech investors may look at revenue and forecast revenue growth and be less comfortable in the pre-revenue space.

However, the reality is that this is a fast moving sector, which following the Covid highs, has seen some substantial company failures and investor losses. So it is still a high-risk sector from the investor perspective.

From a startup perspective, the key is to know who the investors are, deeply understand their mandates and individual target company profiles and then to lean in to those investors that are best aligned with their business.

Quick fire

One underrated opportunity in digital health right now?

Everything that is not badged as AI

There is an enormous amount of money flowing into companies which badge themselves as AI driven technology.That leaves a huge number of other companies, with incredibly strong fundamentals, underfunded and undervalued.

One costly mistake founders can avoid early?

Active avoidance of the regulated path

Avoiding “doing the work” early to achieve appropriate regulatory thresholds will ultimately slow you down just as everyone is expecting you to speed up.

One trend founders should be preparing for over the next few years?

That healthcare will always move slower than technology

Healthcare is a risk averse sector that is intensely conscious of its obligation to firstly “do no harm”. Everything moves slower in healthcare and companies rarely adequately adjust their time and capital requirements accordingly.

This perspective makes one thing clear: digital health success isn’t about having the flashiest technology. It’s about understanding who pays, who benefits, who uses the product and being willing to have your assumptions tested along the way.

ANDHealth+ is Australia’s leading digital and connected health accelerator program, supporting evidence-based digital and connected health SMEs with funding, services, and hands-on support.

If you are a digital health founder ready to prove your commercial viability, the ANDHealth+ Program provides non-dilutive funding, expert validation and resources.

Applications for the ANDHealth+ Program 2025 are now open.

Application deadline: 11:59 pm (AEDT) Friday 16 January 2026

How to apply: via Gust (online submission only)

Program structure: two-stage commercialisation acceleration program

Funding support: up to $5 million in non-dilutive project funding, tranched by agreed milestones

Key benefit: no equity requirements or IP transfer

What we’re thinking about

🤖 Why most AI isn’t delivering (and why the real issue is us, not the tech). This article on Linkedin explores why companies aren’t seeing any meaningful impact from AI at all. It’s not because the models are bad but because people don’t understand how these systems make decisions. Without that clarity, trust and adoption stall before anything can scale.

This MIT piece adds a useful macro lens: the missing impact might also reflect timing. Big productivity shifts often lag because organisations need new data foundations, reworked processes and reskilled teams before AI can meaningfully move the dial.

It also raises a deeper question: maybe productivity isn’t showing up because AI isn’t being aimed at the sectors that drive the real economy. Tools that genuinely support nurses, teachers or manufacturing workers could matter far more than upgrades to already-digitised professions.

🤝 We loved this video from LaunchVic about choosing investors wisely. It’s easy to focus on capital, but the real question is alignment: who understands what you’re building and how you want to build it? Hear from our own Rachel Yang, as well as other VCs, about what founders should look for in an investor.

🌍 Tailwind’s new Adaptation & Resilience Playbook provides a rare look at the climate adaptation market. The big message? The world is already spending over U$1.4 trillion every year adapting to climate change, but adaptation startups receive just 3% of climate tech funding: holding back solutions communities urgently need. The report also highlights how uneven the innovation landscape is.

There’s growing momentum in areas like water systems, climate-risk analytics and building cooling but many of the world’s most urgent needs are deeply physical: flood protection, resilient housing, soil health, wildfire prevention. And because governments, households and corporates all buy resilience differently, founders will need sharp, specific go-to-markets rather than broad “climate” narratives.

It’s a reminder that adaptation with urgent needs, overlooked entrepreneurs and huge potential for impact.

✨🧪A new kind of evidence. A growing set of technologies is offering researchers something they’ve long lacked: evidence that reflects human biology. Organ chips, lab-grown tissues and digital twins offer glimpses we never had before, and together they build an evidence base rooted in people rather than proxies.That scientific momentum sits alongside policy moves like the UK’s plan to wind down some animal tests by 2030.

📚When the foundations set, AI’s real growth begins. Rob Go’s latest essay makes something clear: the centre of gravity in AI is shifting. As the infrastructure race matures, the next wave belongs to founders building practical, everyday applications that actually solve problems. It’s not about outmuscling the giants, it’s about creating value where people feel it. The opportunity ahead isn’t smaller. It’s wider, more accessible and up for grabs.

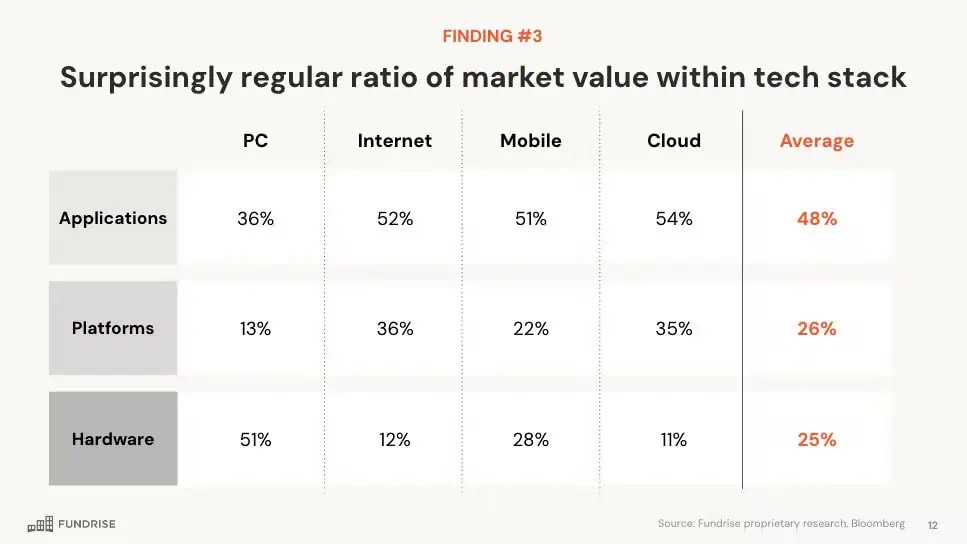

If Fundrise’s chart is any clue, across every tech cycle nearly half the value ultimately shifts to the application layer: AI is just following the same curve.

Source: Fundraise via Rob Go’s essay.

🧠 What if creativity wasn’t magic at all, but something closer to math? This video dives into how creativity works: from Simonton’s “law of large numbers” (great ideas come from many attempts) to Margaret Boden’s idea that creativity is really just new combinations of what we already know. It’s a lovely reminder that innovation isn’t a lightning bolt. It’s practice, patience and the willingness to play at the edge of chaos.

🌱How leaders navigate menopause. A new study shows menopause at work isn’t one story but many. 87% of senior leaders stayed effective at work but the nuance lies in how. Women with medical knowledge, workplace allies and psychological safety navigated symptoms more smoothly; those without struggled. For many, managing menopause became a turning point that deepened resilience and leadership maturity but only when the surrounding systems supported them.

🔥Miss the headlines? Climate investing has flipped the script. New BCG analysis cuts through the “climate investing is dead” narrative. With 55% of low-carbon technologies already cost-competitive and strong policy tailwinds in the EU and APAC, the opportunity set is expanding especially in circularity, adaptation and resilience. After analysing 46 subsegments, BCG finds a broadening landscape of investable climate solutions… just as valuations become more attractive.

Further reading & listening

Paul Ramsay Foundation’s 2025 Sustainable Impact Report deepens their commitment to what they call a “Total Impact Approach”, exploring how their capital can create positive impact beyond what has traditionally been allocated to grants.

Listen to how Michael Tefula from Ada Ventures, a pre-seed VC fund, has built AI tools for founders, not for making investment decisions. What started as a simple tool used by 200 founders a month has grown into Deck Genius that provides detailed pitch deck feedback.

In the news

💥 Finally, clarity for new parents. WORK180’s new calculator reveals the actual parental-leave numbers for 7,000+ employers: government pay, employer top-ups and what it means for your actual income. A simple idea with outsized impact on one of life’s biggest transitions.

🔋Amber secured a further A$10m to supercharge its global rollout. The round brings in E.ON Next UK and Australian climate-tech fund Virescent Ventures, backing Amber’s vision for households to become active players in the clean-energy grid.

🩺 What does it take to scale evidence-based pain recovery? According to MoreGoodDays founder Nel Fulia: aligned payers, lived experience and a willingness to put everything on the line. We loved this reflection on why meaningful health impact depends on business models as much as science, hearing how alumni now apply to join the team and how being a founder has pushed her far beyond past roles.

✈️ A huge milestone for FlyORO, and for Australia’s SAF future. Amid Australia’s new A$1.1bn push to build a local sustainable aviation fuel industry, FlyORO has activated its first modular SAF-blending unit in Queensland. The tech lets airports blend SAF on-site, in hours, rather than relying on distant refineries. Read our Theory of Change for FlyORO below.

ICYMI, you can read the raise releases on Indi (Capital Brief - paywall / Startup Daily) and Teacher’s Buddy (Capital Brief - paywall / Startup Daily).

New Paths

🔋Amber Electric is hiring across Melbourne and London; and in Melbourne alone, roles span Product Marketing, Product Design, Engineering Management, IT Operations, Sales, Talent and CX Operations.

🎧 Foremind is looking for a EAP clinician.

🧻 Who Gives A Crap is hiring across Australia, Los Angeles and Manila. In Australia, roles include Senior Software Engineer, Performance Creative Lead, Lifecycle Marketing Analyst, National Account Manager and Growth Lead.

🪰 Goterra is hiring a Site Manager, Waste Team Lead and Waste Operator (Wetherill Park) and Waste Operator (ACT).

🌳 Gandel Invest is looking for an Innovation Hub Operator to build and operate a founder-focused space in Melbourne.

Save the date

📅 17 December 2025: LaunchVic’s Victorian Startup Founder Survey. Victoria’s startup community has grown from 2,650 to over 4,300 since 2022, and LaunchVic’s confidential founder survey will help explain why. If you are a Victorian startup founder, take the survey here. Your input shapes the data guiding ecosystem support and future programs.

📅 16 January 2026: Applications close for ANDHealth+. Are you ready to grow and scale your digital and connected health business? Learn more and apply here.

📅 16 January 2026: Applications close for EnergyLab’s EnergyLab’s Investment Ready Program (QLD), a program supporting Queensland-based climate tech founder considering raising capital. Learn more here.

📅 8 February 2026: Applications close for RMIT’s [Re]Launch, a pre-accelerator program for startups operating within the circular economy. Apply here.

📅 2 March 2026: Applications close for EnergyLab’s Climate Tech Lab to Market Program. The 9-week program is designed to help researchers explore entrepreneurship as a commercialisation pathway for your research. Learn more and apply here.